Okay, let’s get ready. Here comes the unknown but quite interesting

topic—credit scores. It’s a term likely used by banks, loan officers, or those

people in your life who enjoy reminding you that grown-up things are

necessary to know. But what really does the credit score mean? And why

does it seem as if every tiny purchase is connected to this figure, which, let’s

face it, sounds more like some grade we would prefer not too often recall?

Let me present you with Your Comprehensive Guide to Credit Scores If You

Are a Gen Z. We’re going back to ground level, telling you how every

additional coffee affects you and how even the most minuscule choices can

take your credit sky high or drag it down a little.

What Even Is a Credit Score?

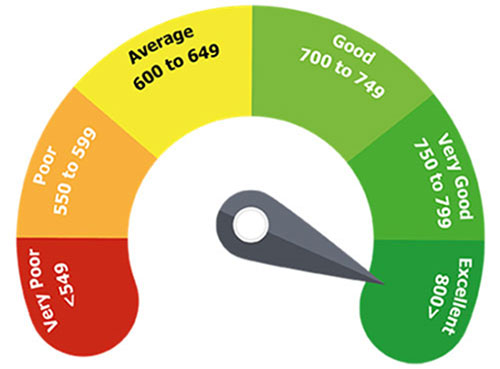

So let’s put it in simple words: a credit score is simply a three-digit number

that will express your ‘credit worthiness’. Essentially, it is a kind of

grown-up GPA but way less exciting; it is somewhere you’d want to be. This

score informs the lenders—banks, credit card companies, etc.—whether you

are likely to repay the money they advance you. It usually ranges between

300 and 850; the nearer to 850 on the scale, the more your a financial fairy

godmother; the nearer to 300, well, isn’t so great.

The higher your score, the better your chances of getting approved for

loans, apartments, and sometimes even jobs. And, if your score is chef’s kiss

high, you might even score lower interest rates, meaning you save on that

sweet borrowed cash.

Why Does It Matter?

Imagine this: You’re looking at a new iPhone or setting your sights on a new

apartment. But one fine day the finance company or your landlord requires

your credit score. Uh-oh. Your unplanned run to buy items you do not need

might be coming back to check on you right now. Yes, you could say that

your credit score is a kind of ‘financial background check.’.

Pro Tip: Credit is indeed regarded as gold that is well known as the key to

unlocking privileges. Bad credit? It’s like being in a video game in which

each level advances a few spaces, yet it’s exponentially more challenging

than required.

Credit scoring: A Beginner’s Guide

Credit scores are calculated using a mix of factors, like:

Ability to pay (35%): That means, did you pay your dues on time? This is

similar to the attendance grade; if you’re present at the venue and pay on

time, you pass; otherwise, you fail.

Credit utilization (30%) Currently, how often are you charging things to

your credit card? It’s never a good thing to borrow close to your limit.

Length of Credit History (15%) In how many years have you been managing

credit? Kind of like, “How long has it been since you started acting like a

responsible grownup?”

These are credit cards, student loans, auto loans… (10%) Variety is nice.

Recent Inquiries (10%) Every time you apply for credit, it’s a little ding on

your score. Be choosy!

So, yeah, it’s a blend, and every small choice feeds into one of these factors,

nudging your score up or down.

How to make big financial changes even when you can’t afford

them

This is where it gets interesting. Every cent here can either help your score

increase or be sent to the credit penalty box. Let’s look at some scenarios.

- Cheating Your Friend’s Pizza Money

‘It will operate without my contribution,’ you finally and arrogantly think to

yourself. Though, just yes, what if you are used to not paying bills—like

rent, credit card bills, or this loan you agreed to take for a PS5? This is very

damaging to credit, as they say, ouch. In addition, one outstanding payment

decreases your score for as long as seven years. - Buying New Kicks on Your Credit Card to Reach the Credit Limit.

Oh yes, that credit card limit is not a gauntlet thrown down to the world to

swipe, swipe, swipe. Some experts advise using not more than a third of

available credit. For example, if your credit limit is $1000, then you should

not have more than $300 charged at once. It informs banks that you are

responsible with credit without having to bring the limit to its full amount. - Borrow Like it is a collectible:

Auto loans, student loans, that card from your favorite department store

that brings you an extra bit of plastic. In this situation, the types of credit

that you use play the role of determining the quality of the credit. Lenders

can get nervous with too much of one thing or taking out multiple loans at

once. - Applying for Multiple Credit Cards to Score Freebies

Yes, that shiny new card promises rewards and maybe a discount on those

sneakers, but applying for too many credit cards in a short period makes

you look like you’re hunting for credit. This can temporarily lower your

score.

Positive Habits That Can Improve Your Credit Rating

At least now we know what not to do. Let’s look at how to harness the credit

score to our advantage. Here is what you need to know to get a financial

halo to guide its path. - Auto-Pay is Your Bestie

Your credit score heavily depends on the payments and if you’re habitually

late, this will have an adverse effect so ensure that you set automatic

payments for the at least minimum amount on your credit cards or loan.

Thus, it enables you not to be charged with the bad penny and be

good-looking to credit bureaus. - Keep credit utilization low.

Remember the 30% rule? It is recommended to charge only up to 30% of

your limit on your credit card. If you’re about to go over, you may want to

put the brakes on your impulse buying of the latest gadget on your credit

card. - Build credit history slowly.

If you’re a beginner in credit, remember that in the credit business,

patience is installing. Do not apply for credit cards and get approved for

several cards at the same time. To begin with, you can start with one or two

and ensure you are making payment on time. - Check Your Credit Report

You have the opportunity to get a free credit report one time per year on the

website AnnualCreditReport.com. Sift through it looking for flaws—if there

was an error made that you see on the list that shows you are unpaid, then

enhancing on it will help make the grade.

A Quick Myth-Busting Session

‘”I Don’t Use Credit, So My Score Is Perfect!’”

Nope. If you do not have a credit history, then you are not going to have a

high credit score in the first instance. It’s like truancy; you cannot make an

A list if you don’t attend the classes.

Thanks to Some, It Hurts It When I Check My Own Score

False alarm. You can view your credit score as many times as you want (this

is also known as a soft inquiry) without hurting your score. Soft inquiries

rarely show up on reports and only when a lender performs a ‘hard inquiry

will your score be pulled down.

‘I Should Close Old Credit Cards I Don’t Use’

Not so fast! This means that the number of years of credit history that you

have declines your score. Unless it charges a very steep annual fee in some

cases, it may actually be beneficial to your credit score to keep it open.

TL; DR (Too Long; Didn’t Read)

Credit Score 101: It’s a three-digit number about how responsible you are

with it, with the numbers between 300 and 850.

The Five Key Factors: Do not pay bills late, demonstrate a manageable

credit card limit, have credit accounts of different types, do not close credit

accounts, and do not apply for credit on several occasions.

Small Decisions = Big Impact: That cup of coffee on your credit card,

telephone bill, or that swipe over the limit? All those actions impact your

credit score or credit file.

Final Thoughts

Understanding credit scores doesn’t have to feel like a deep dive into

finance jargon. It’s actually pretty simple: act responsibly with the money

you borrow, don’t overuse your credit, and pay on time. Your credit score is

kind of like a social score in the finance world—it shows people (or banks,

rather) that you’re responsible and trustworthy.

So next time you’re about to swipe that card for an impulse buy or ignore

that bill reminder, think about the little impact it could have on your score.

And remember, it’s never too early (or too late) to start building a healthy

financial foundation.